Following the reduction of the tourist tax for owners in Croatia in 2020 due to the Covid 19 pandemic, the responsible ministry has now also created a possibility for all owners affected by this regulation to get back any overpayments or to have them credited to the coming year. The binding regulation for this is laid down in Article 14 of Regulation 73/2020 NN.

Criteria for reimbursement of the tourist tax

In order to spare our readers from having to understand the sometimes difficult text of the regulation, we have summarised the criteria for a refund in a way that is generally understandable.

Owners get 20 % back

According to the above-mentioned regulation are entitled to reimbursement of 20% of the (pro rata) tourist tax paid for the year 2020:

- Owners who have paid the lump sum in 2019, if the payments also concern certain periods in 2020

- owners who have paid the lump sum for the entire year 2020 at the Port Authority or a branch office of the Port Authority in 2020, at the latest by 29 June 2020

To be entitled to exemption from the tourist tax:

- Owners whose package includes the period from 23 March to 11 May

Repayment or extension

Right of option for reimbursement:

- Owners can apply for reimbursement of the overpaid tourist tax to their bank account

- Owners can apply for an extension of the period for which the tourist tax was charged and have it offset against the overpayment The Croatian National Tourist Board issues a confirmation of payment for this purpose.

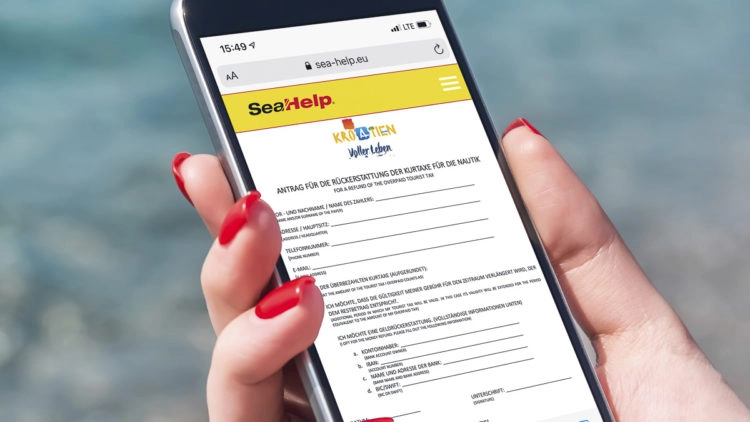

The tourist tax will be refunded if you fill in the form available for download here and send it to nautika@htz.hr with a copy or photo of the invoice for the tourist tax from which a part has been overpaid.

Croatian authority thoroughly checks

Since the competent authority will thoroughly examine the applications for reimbursement of the tourist tax, owners should first of all be patient. With this in mind, it would generally be important to make an exchange here via Facebook, so that owners who have submitted such an application can find out how to estimate the processing time – also to avoid unnecessary inquiries with the Croatian National Tourist Board.

Translation of the text of the Croatian regulation

The Regulation which governs the facts of the case reads mutatis mutandis (no literal translation) in Article 14:

Owners who have paid the fee in 2019 for a period within 2020 do not have to pay again for that period – the fee paid remains valid until its expiry.

If the period for which the owners paid the fee was within the COVID-19 epidemic (on Croatian grounds), the owner may request the partial refund of the fee paid, or request the proportional extension of the period.

Both applications are made to the Croatian Tourist Board.

Reimbursement can only be applied for personally

In general, it should be noted that the refunding of the tourist tax cannot be made through third parties, but each boat owner must make a personal application to the Croatian National Tourist Board, and the refunding of the overpaid tourist tax can only be made to his specified account.